To DIY or Not to DIY (your Finances), That Is the Question

Financial planning is like putting together IKEA furniture: sometimes you get it right, and other times you end up with an unstable shelf and three mystery screws. To assist you in determining when to get your hands dirty and when to call in the specialists, continue reading.

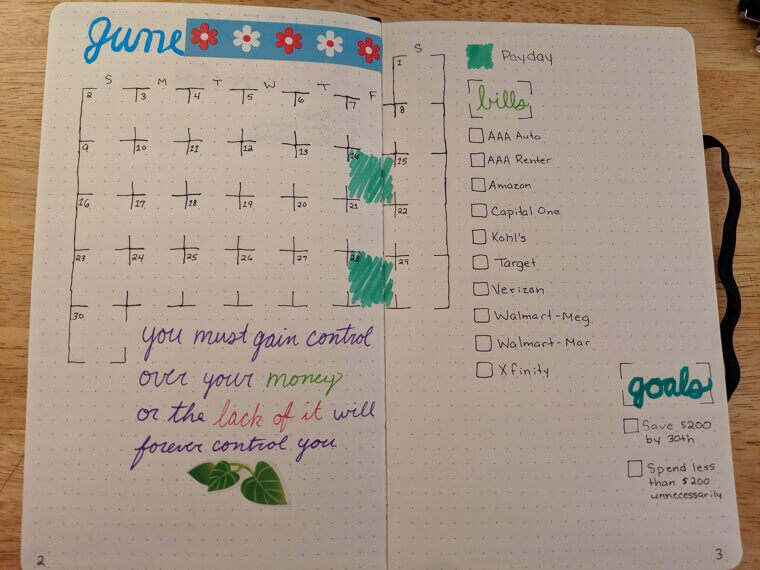

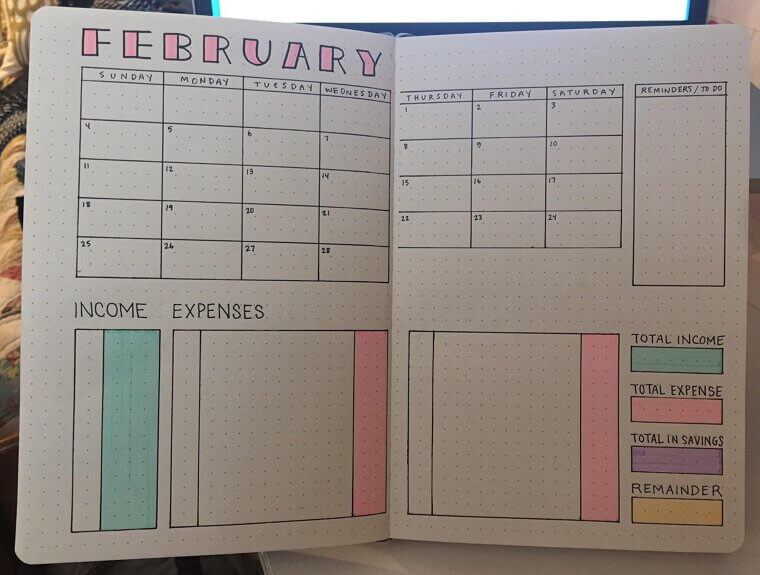

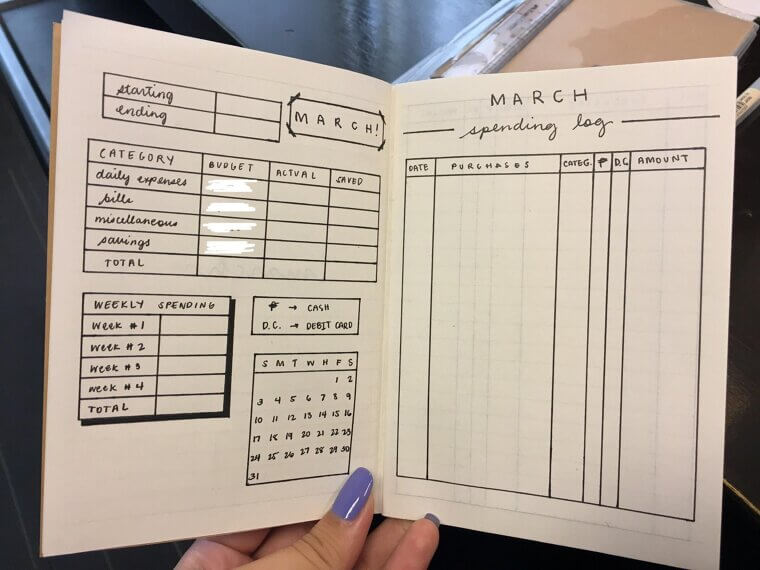

Budgeting Basics – DIY

Keeping tabs on your earnings and outlays? Absolutely possible. Setting objectives and classifying spending are made simple by apps like YNAB and Mint. It's an excellent method of developing financial literacy without requiring an expensive consultation or an economics degree.

Filing Simple Taxes – DIY

Tax software can take care of it if you're a single W-2 worker without any investments or dependents. Hitting "submit" without experiencing a spreadsheet meltdown is surprisingly pleasant, quick, and reasonably priced.

Investing in Index Funds – DIY

Low-cost index funds are the crockpot of investing: set it, forget it, and let compound interest do its thing. With a bit of research, you can build a diversified portfolio without needing a Wall Street whisperer.

Estate Planning – Call a Pro

Power of attorney, trust, and will documents are legal protections, not just paperwork. A specialist guarantees that your desires are precise, enforceable, and suited to the requirements of your family. Copy-and-paste templates are not appropriate at this time.

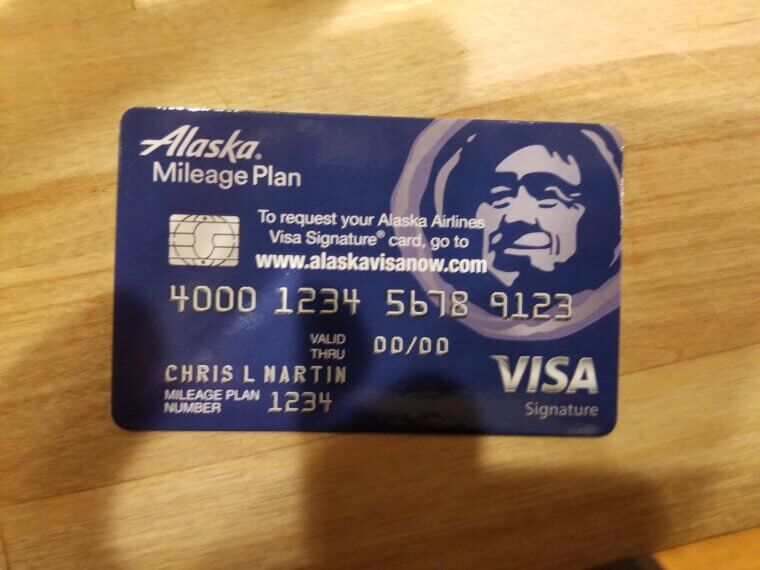

Managing Credit Card Debt – DIY

Is the avalanche or snowball method of DIY credit card debt management better? Decide on a plan and start chipping away. You can handle credit card debt on your own with self-control and a spreadsheet, but remember to chop up the plastic if temptation arises.

Navigating Bankruptcy – Call a Pro

Speak with an Expert! Bankruptcy is a difficult, sensitive, and legally fraught situation. A skilled lawyer can help you rebuild with dignity, safeguard your possessions, and lead you through the process. This isn't a do-it-yourself moment.

Choosing a Bank – DIY

Online or brick-and-mortar? High-yield savings or cashback checking? You can compare features and fees yourself. Just read the fine print - those “free” accounts sometimes come with sneaky conditions, so watch out.

Buying Life Insurance – Call a Pro

Term or whole life? Riders, exclusions, and underwriting can get confusing fast. A licensed agent helps you match coverage to your goals and budget, without overselling you on bells and whistles you don’t need.

Setting Up an Emergency Fund – DIY

Concealed in a high-yield savings account, enough to cover three to six months' worth of expenses. It's easy, empowering, and completely do-it-yourself. Simply automate your deposits and act as though there is no money.

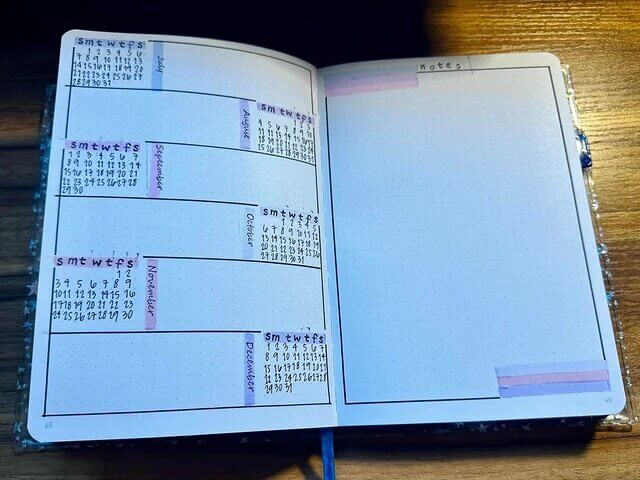

Planning for Retirement – Call a Pro

Between IRAs, 401(k)s, Roth conversions, and withdrawal strategies, retirement planning is a maze. A financial advisor helps you optimize tax efficiency and avoid costly missteps, especially if you’re juggling multiple income sources.

Tracking Net Worth – DIY

Net worth is equal to assets minus liabilities. It's a simple formula, but it's incredibly fulfilling to watch it develop over time. Keep track of things with a spreadsheet or app; it's similar to taking a financial selfie.

Handling Student Loans – Call a Pro

It's a jungle with federal vs. private, income-driven repayment plans, and forgiveness programs. If you have loans from several servicers, a student loan counselor can help you sort through your alternatives and steer clear of expensive blunders.

Saving for a Vacation – DIY

Dreaming of Bali or Brighton? Set a goal, open a dedicated savings account, and stash away a little each month. It’s a fun, tangible way to flex your budgeting muscles.

Buying a Home – Call a Pro

Between mortgage types, down payments, and closing costs, home buying is a high-stakes puzzle. A financial planner or mortgage broker helps you understand what you can truly afford - and what to avoid!

Creating a Side Hustle Budget – DIY

Despite the unpredictability of freelance income, a basic budget aids in managing cycles of abundance and scarcity. Keep tabs on profits, save taxes, and reinvest prudently. It's a fantastic method to develop financial self-control.

Planning for College – Call a Pro

Between 529 plans, FAFSA strategies, and scholarship searches, college planning can feel like a full-time job. A financial advisor helps you balance saving with other life goals, navigate tax benefits, and avoid common missteps. With tuition costs rising, expert guidance ensures your plan is smart, sustainable, and tailored to your family’s future.

Negotiating a Salary – DIY

With a strong research foundation and a convincing pitch, you can ask for what you're worth without the assistance of a consultant. Prepare yourself by researching market rates and practicing your value offering. Negotiating a salary involves both strategy and self-belief. When done correctly, it can advance your career and income without charging you a dime.

Handling an Inheritance – Call a Pro

It can be both financially and emotionally taxing to receive an inheritance. You may respect the legacy, but comprehend the tax ramifications, and make informed decisions that support your long-term objectives with the assistance of a financial planner.

Setting Financial Goals – DIY

Whether you’re saving for a car, launching a business, or dreaming of early retirement, goal-setting starts with clarity. Write down your objectives, break them into actionable steps, and track progress regularly. It’s empowering, personal, and completely DIY-friendly.

Managing Rental Property Finances – Call a Pro

Depreciation, deductible repairs, and passive activity regulations are some of the tax complexities associated with rental revenue. A CPA or financial counselor assists you in maximizing deductions, avoiding costly mistakes, and maintaining compliance.

Choosing Health Insurance – DIY

Shopping for health insurance isn't glamorous, but it's doable. Examine coverage networks, copays, deductibles, and premiums using comparative tools. You can discover a plan that works for you and your budget, but it will take time and perhaps a strong cup of coffee. Just make sure to look for hidden fees and read the fine print.

Planning Charitable Giving – Call a Pro

Charitable giving can be heartfelt and strategic. A financial advisor helps you explore donor-advised funds, appreciated assets, and tax-efficient ways to give. Whether you’re donating monthly or planning a legacy gift, professional input ensures your generosity goes further.

Building Credit – DIY

Establishing good credit is a slow but rewarding process. Start with a secured card, pay bills on time, and keep your credit utilization low. Monitor your score and avoid quick-fix schemes or shady repair services.

Selling a Business – Call a Pro

Turning over the keys is only one aspect of selling a business. It's a complicated procedure that encompasses a range of activities, including succession planning, legal contracts, tax planning, and appraisal. A financial advisor ensures that you don't miss out on chances or make costly blunders while assisting you in making a smooth and profitable departure!

Tracking Subscriptions – DIY

Streaming, software, gym memberships - we all know subscriptions add up. So, use an app or spreadsheet to track and trim. It’s oddly satisfying to cancel that forgotten trial and reclaim your budget - not to mention very accessible and easy to learn!

Planning for a Baby – Call a Pro

From maternity leave to childcare costs and college savings, babies change everything. A financial planner helps you prepare for the short-term chaos and long-term expenses. Cute, but costly.

Managing Freelance Taxes – Call a Pro

Self-employment taxes, quarterly payments, and deductions can get messy. A tax pro helps you stay compliant and avoid penalties. It’s worth the peace of mind. It’s better to be safe than sorry when it comes to taxes!

Reviewing Insurance Policies – DIY

Home, auto, renters - review coverage annually and shop around. You can compare quotes and adjust limits yourself. Just make sure you’re not underinsured or overpaying. This will take just 10 minutes of your time!

Planning a Wedding – DIY

Set a budget, prioritize what matters, and track expenses. It’s your day - your way. Just don’t forget to factor in the honeymoon and those sneaky vendor fees. Even if you're planning a large wedding, the expenses can still be easy to manage.

Handling Divorce Finances – Call a Pro

Dividing assets, managing alimony, and updating estate plans require expert guidance. A financial advisor helps you rebuild with clarity and confidence. It’s a fresh start, not a financial freefall.

Choosing Investment Platforms – DIY

Robo-advisors, brokerage accounts, mobile apps; there’s a platform for every style. Compare fees, features, and usability. It’s like dating, but for your money; so pick which one is right for you and stick to it!

Planning for Elder Care – Call a Pro

Long-term care, Medicaid planning, and family dynamics are complex. A financial planner helps you navigate costs and options with compassion and clarity. It’s about dignity and preparedness.

Tracking Business Expenses – DIY

Receipts, mileage, and software subscriptions need to be kept organized. Use accounting apps or spreadsheets to stay on top. It’s tedious, but essential for tax time and financial clarity, and might even save you money in the future.

Evaluating Investment Risk – Call a Pro

Risk tolerance, market cycles, and asset allocation aren’t one-size-fits-all. A financial advisor helps you invest wisely based on your goals and temperament. It’s strategy, not guesswork, so it’s best to leave it to the pros!

Reviewing Your Financial Plan – Call a Pro

Even the best DIY plans benefit from a second opinion. A professional review can catch blind spots, offer new strategies, and keep you on track. Think of it as a financial tune-up and you’ll be left with no doubts!